Our Firm

Orchestra Private Equity (“Orchestra”) was founded in 2014, which targets to make control investments in leveraged buyouts in the smaller end of the middle market (“SEMM”) in Japan and Korea.

Senior team of Orchestra has SEMM buyout experience in Japan and Korea including investment, financial, operating, and M&A expertise, which are critical components of Orchestra’s foundation.

Orchestra is headquartered in Singapore with a Capital Markets Services – Accredited Investors license from the Monetary Authority of Singapore while the investment teams are in Tokyo, Japan and Seoul, Korea. All Orchestra members are Japan, Korea, and Singapore-native, multicultural-talent with English fluency. Members work under a firm-wide matrix structure and are fluidly assigned to cross-border projects.

Investment Philosophy and Strategy in the SEMM Market

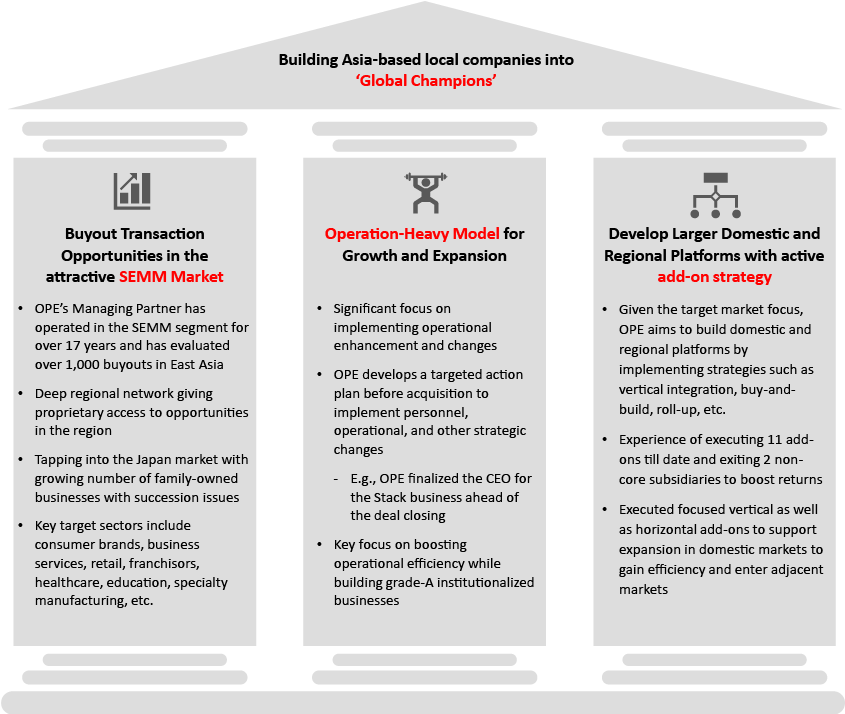

The ‘Orchestra SEMM Model’, which equates to Orchestra’s investment philosophy and the Fund’s investment strategy, is to build strategic assets by identifying and acquiring local companies in attractive industries that align with local consumption trends. Orchestra leverages local expertise and forms strong partnerships with experienced management teams to grow these local companies into ‘global champions’.

Orchestra understands the advantages of as well as the challenges faced by global firms investing in Japan and Korea. Orchestra has localized the effort and refined and adapted the SEMM buyout model to the ‘Orchestra SEMM Model’.

It employs a hybrid strategy of ‘organic growth’ and ‘buy-and-build’, while building ‘grade-A management teams’ and doubling market coverage through ‘cross-border expansion’.

Orchestra’s hands-on approach to value creation is based on utilizing the team’s experiences and working closely with the portfolio company management teams to enhance the intrinsic value of the businesses through organic growth, geographic expansion, institutionalizing businesses by developing a strong executive bench, and executing add-on acquisitions domestically and globally.

Operational Heavy Lifting and Add-on Acquistion

Orchestra has a well-defined plan focused on operational enhancements and is involved heavily in the post-acquisition operations of its portfolio companies, implementing both management team and systemic changes.

Orchestra works together with management teams to successfully source and execute add-on transactions. Add-on investments include horizontal & vertical Integration, buy-&-build, roll-up, and public-to-private.

Not only do these add-on acquisitions help accelerate both global and regional expansion, but also help with significant value creation via opportunistic subsidiary exits.

Investment Criteria

Orchestra's investment criteria are fine-tuned to reflect the unique nuances of the Japanese and Korean markets, fully incorporating macroeconomic trends, industry sustainability, regulatory frameworks, and financing accessibility. Orchestra will seek to invest across industries in which it believes Japan and/or Korea maintain a global competitive advantage. Orchestra believes that both countries maintain core competencies in value-added manufacturing, which is driven by a combination of strong and continued development of technological innovation across sectors and manufacturing processes with global cost competitiveness and high quality. Investment criteria are localized to Japanese and Korean accord, based on each country’s macro trends, industry’s long-term viability, segment’s regulatory environment, and company’s acquisition financing accessibility.

Although Orchestra may invest across any industry or sector in which it sees an attractive opportunity, the following industries are examples of Orchestra’s investment activity in terms of ‘industries targeted’:

- Consumer brands

- Retail

- Business services

- Education & training

- Franchisors

- Healthcare

- IT & software/SaaS

- Specialty manufacturing & distribution