Environmental, Social, and Governance (“ESG”)

ESG have an impact on the communities in which Orchestra Private Equity and its portfolio investments operate. Orchestra believes that incorporating ESG-related principles throughout its investment lifecycle and operations supports the mission of building long-term value for its stakeholders.

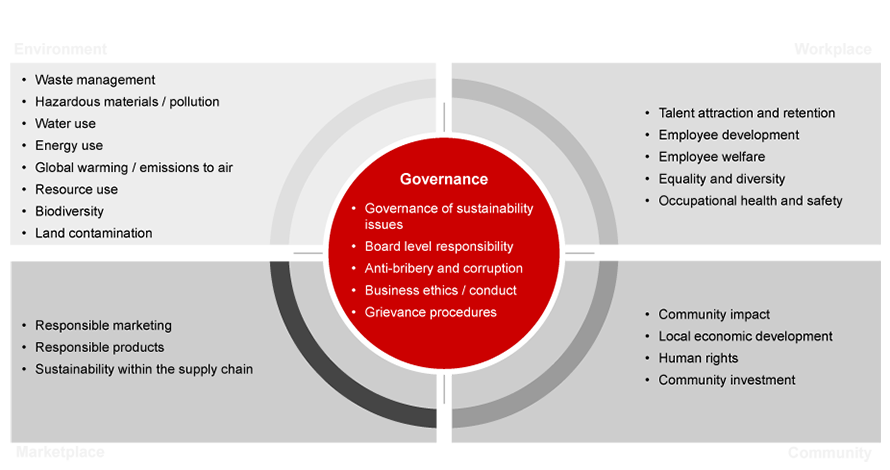

Orchestra’s ESG policy provides a framework for the shared values and responsible business practices that all employees and portfolio companies are expected to follow. Orchestra’s philosophy is based on building long-term value driven by sustainable value creation through engaging a well-defined set of investment criteria incorporating ESG considerations, which in turn mitigates risk, and helps to build long-term value for the stakeholders across OPE’s investment strategies. Orchestra is committed to being responsible stewards of the capital entrusted to OPE by the investors and will endeavour to support OPE’s shared ESG objectives. A copy of OPE’s ESG Policy can be made available to the investors upon request.

More importantly, to demonstrate Orchestra’s commitment to ESG, OPE has become a signatory to the United Nations - Principles for Responsible Investment Association (“UN PRI”) in 2023. Orchestra acknowledges the relevance of ESG issues to investment management, and commits to providing, promoting, and improving services that support the implementation of the following six principles:

- To incorporate ESG issues into investment analysis and decision-making processes.

- To be an active owner and to incorporate ESG issues into Orchestra’s ownership policies and practices.

- To seek appropriate disclosure on ESG issues by the entities in which OPE invests.

- To promote acceptance and implementation of the principles within the investment industry.

- To work with the PRI Secretariat and other signatories to enhance their effectiveness in implementing the principles.

- To report on Orchestra’s activities and progress towards implementing the principles.

Several ESG initiatives implemented across Orchestra offices together with its portfolio companies are as follows:

Compliance with applicable laws and regulations and, where appropriate, relevant international standards governing ESG including corporate governance, the protection of the environment, labour, occupational health & safety, product stewardship and human rights in jurisdictions where Orchestra and portfolio companies conduct their businesses.

Adherence to the highest standards of conduct intended to avoid negligence, unfair or improper practices including anti-bribery and corruption, anti-social forces as well as management of conflict of interests.

Screening of new investment opportunities against Orchestra’s existing negative screening lists which are developed to reflect the approaches of its stakeholders. Specifically, OPE avoids investing in companies that are directly engaged in or associated with weapons, tobacco, pornography, unregulated gambling, fossil fuels (coal, oil and gas) mining and other environment unfriendly industries.

Identification, disclosure, mitigation, and management of ESG risks and opportunities including the ones affecting or affected by climate changes and other mega trends through Orchestra’s due diligence process before making investment and divestment decisions.

Encouragement of portfolio companies to adopt ESG risk and opportunity management in a manner that is consistent with the nature of their operations and maintain regular audit and communications with the portfolio companies to assess ESG impact, compliance, and continuing improvements to promote sustainable growth.

Disclosure of material ESG related information to Orchestra’s investors when required, in a manner that is consistent with investors’ initiatives in these areas.

Reduce carbon footprint by minimizing excessive electricity and water usage in all Orchestra and portfolio companies’ factories and offices as well as reduction of paper printing in contracts, reports, and other documents.

Compliance

The investors, investments, operations of Orchestra span across multiple geographies. Compliance is a fundamental philosophy of OPE, essential to ensure OPE’s continuing existence and success.

Orchestra is committed to ensure that it complies with all applicable laws and regulations, and that it strives to meet the requirements of those standards and codes of practice that apply to its day-to-day operational activities and responsibilities.

Through adopting a stringent and yet practical approach, coupled with a framework comprising of policies, codes of conduct, rules, and procedures, Orchestra is able to meet regulatory objectives to protect investors and ensure that markets are fair, efficient and transparent while reducing system risks and eliminating financial crimes.

In addition to regulatory objectives, OPE’s compliance policy is formulated to instil investors’ confidence in OPE with governance over key concerns of risk management, marketing, communications, data privacy, conflicts of interest, insider trading, client assets and monies as well as rule-breaking and errors.

OPE Singapore holds a Capital Markets Services ("CMS") acredited Investors license with the Monetary Authority of Singapore (“MAS”).

As a licensed fund management company, OPE Singapore is obliged to develop and maintain a comprehensive Compliance Framework with policies and processes to ensure conformity with the Securities and Futures Act of Singapore, as well as MAS rules and regulations.

OPE updates its Compliance Policy every 2 years or whenever necessary to keep in line with regulatory changes. A copy of OPE’s Compliance Policy can be made available to the investors upon request.