Our Firm

Orchestra Private Equity began investing in 2017 and focuses on control investments in leveraged buyouts at the smaller end of the middle market (“SEMM”) in Japan and Korea.

The firm’s senior team brings deep experience across the full buyout lifecycle, including investment execution, financial structuring, operational value creation, and M&A. Orchestra actively partners with portfolio company management teams to drive organic growth, execute strategic initiatives, and scale businesses into stronger, more institutional platforms.

Orchestra Private Equity is headquartered in Singapore and holds a Capital Markets Services (“CMS”) license issued by the Monetary Authority of Singapore. Its investment professionals are based in Tokyo and Seoul. The team comprises Japan, Korea, and Singapore-native professionals with strong English fluency and multicultural backgrounds, operating within a firm-wide matrix structure that enables disciplined execution and seamless collaboration across borders.

Investment Philosophy and Strategy in the SEMM Market

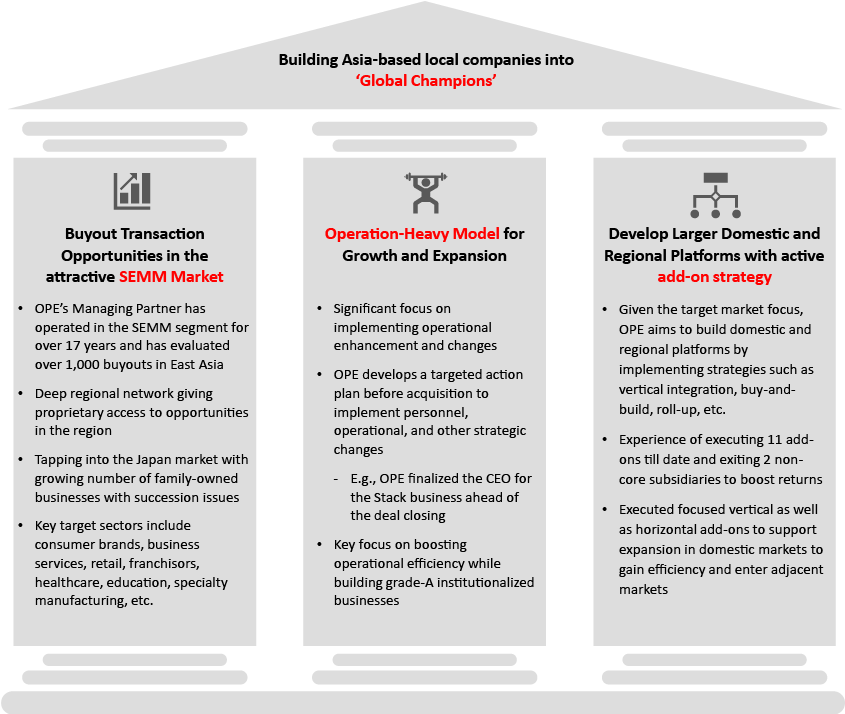

The Orchestra Private Equity SEMM Model defines Orchestra’s investment philosophy and underpins the Fund’s investment strategy. Orchestra builds strategic assets by identifying and acquiring high-quality local companies in attractive industries aligned with domestic consumption trends and scaling them into market-leading “Champions.”

Orchestra Private Equity leverages deep local expertise and forms strong partnerships with experienced management teams to execute value creation. With a clear understanding of both the advantages and challenges faced by global investors in Japan and Korea, the firm has refined and localized the traditional SEMM buyout approach into the proprietary “Orchestra SEMM Model”.

Orchestra Private Equity executes a hybrid value-creation strategy that combines organic growth and disciplined buy-and-build, while building institutional-grade management teams and expanding market coverage through selective cross-border growth. Through active ownership and a hands-on approach, Orchestra works closely with portfolio company management teams to enhance intrinsic business value via operational improvement, geographic expansion, organizational institutionalization, leadership development, and the execution of highly selective domestic and global add-on acquisitions.

Operational Heavy Lifting and Add-on Acquistion

Orchestra Private Equity maintains a well-defined value-creation plan centered on operational enhancement and active post-acquisition ownership. The firm is deeply involved in portfolio company operations, implementing both management-level initiatives and systemic improvements to drive performance and scalability.

Working closely with management teams, Orchestra Private Equity actively sources and executes add-on acquisitions as a core component of its strategy. These transactions include horizontal and vertical integrations, buy-and-build and roll-up strategies, as well as selective public-to-private opportunities.

Beyond accelerating regional and global expansion, add-on acquisitions serve as a powerful engine for value creation, including through opportunistic subsidiary carve-outs and exits that further enhance overall investment returns.

Investment Criteria

Orchestra Private Equity’s investment criteria are specifically calibrated to the structural and market nuances of Japan and Korea. The firm incorporates macroeconomic trends, industry sustainability, regulatory frameworks, and acquisition financing accessibility into its underwriting process. Orchestra invests selectively in sectors where Japan and/or Korea demonstrate durable global competitive advantages.

The firm believes both countries possess strong core competencies in value-added manufacturing, driven by sustained technological innovation, globally competitive cost structures, and consistently high product quality. Investment criteria are localized to each market, reflecting country-specific macro trends, long-term industry viability, segment-level regulatory dynamics, and transaction-level financing considerations.

While Orchestra Private Equity remains opportunistic across all sectors, the following industries represent areas of targeted investment focus:

- Consumer Brands

- Retail

- Business Services

- Education and Training

- Franchisors

- Healthcare

- IT and Software/SaaS

- Specialty Manufacturing and Distribution